EDUCATION

Simld: Revolutionizing Smart Image Metadata Lookup and Detection with Precision

Simld enables a new revolution in smart image metadata lookup and detection, offering unparalleled accuracy and intuitive integration. From the moment you begin using simld, it becomes clear that this technology isn’t just another add‑on; it’s an intelligent ally that empowers professionals, hobbyists, and businesses alike. Whether you’re a developer, designer, marketer, or researcher, simld addresses your needs with refined precision, intuitive workflows, and industry‑leading assurances.

What Is Simld and Why It Matters

Simld stands for Smart Image Metadata Lookup and Detection, a cutting‑edge framework that intelligently extracts, interprets, and embeds metadata into digital images. The core of simld lies in its ability to analyze visual data, detect key elements, and automatically generate descriptive tags, caption suggestions, usage rights, and authenticity indicators. Integrating simld into your pipeline means never losing track of image origins, context, or compliance needs again. This fosters trust, legal safety, and organizational efficiency.

How Simld Works: The Core Process

1. Image Ingestion & Pre‑Processing

When an image is fed into simld, the system begins with enhancement routines—color correction, noise reduction, and object isolation—to improve detection accuracy. This pre‑processing sets the foundation for higher fidelity metadata extraction.

2. Feature Detection & Recognition

Simld intelligently identifies faces, locations, brands, text, and notable objects. Combining pattern recognition with contextual reasoning, simld distinguishes a sunset over a beach from a crowded outdoor concert. This level of contextual understanding gives simld accuracy far beyond basic tagging.

3. Metadata Generation

Simld crafts a comprehensive metadata block: descriptive captions suitable for alt text, location tags for geo‑mapping, brand and logo recognition, and usage‑rights flags (for example, “Royalty‑Free,” “Editorial Use Only,” or “Licensed Product”). This reduces manual labor and minimizes errors.

4. Integration & Export

After detection, simld allows seamless export to popular formats—EXIF, IPTC, XMP—or connects directly to CMS, DAM systems, or cloud storage via APIs. This flexibility makes simld adaptable across existing workflows without friction.

Emotional Resonance: Why Simld Feels Indispensable

Many users feel overwhelmed managing large image libraries. Simld steps in like a trusted assistant, turning anxiety about misplaced, untagged, or misused images into calm confidence. The fear of non‑compliance or misrepresentation—especially under regulatory pressures—fades away. With simld, you emotionally connect with your content knowing it’s safely and meaningfully described. That trust builds loyalty and boosts productivity.

Key Features That Set Simld Apart

| Feature | Cost | Efficiency | Ease of Use | Scalability | Benefits |

|---|---|---|---|---|---|

| Automated Tagging | Low | Very High | Plug & Play | Enterprise‑Ready | Saves hours/month |

| Usage Rights Detection | Medium | High | Transparent UI | Multi‑Site | Minimizes risk, ensures compliance |

| Object & Label Recognition | Low | High | Intuitive | Cloud & On‑Prem | Precision in captioning |

| API Integration | Subscription | Medium–High | SDKs & Docs | Customizable | Fits varied workflows |

| Reporting & Logs | Included | Medium | Dashboard UI | Organization-Wide | Auditing & oversight |

Performance Comparison: Simld vs. Traditional Solutions

Traditional manual tagging tools struggle with scale, human error, and lack of context. Simld automates extraction, greatly reduces mistakes, and delivers context‑sensitive insights. Unlike legacy tools, simld learns continually, improving metadata quality over time.

Security, Accuracy, and Trust: The E‑E‑A‑T Foundation

Simld upholds digital trust by aligning with industry best practices: secure encryption in transit and at rest, rigorous audit trails, and continuous validation against standardized datasets. Accuracy benchmarks exceed 95 % under varied lighting and subject conditions. Independent validation confirms simld’s detection precision is on par with the most respected frameworks, satisfying requirements in fields like publishing, healthcare, e‑commerce, and government. This commitment demonstrates expertise, authority, and trustworthiness—values that align with Google’s E‑E‑A‑T guidelines.

Real‑World Applications: Where Simld Drives Impact

Content Marketing

Marketers automate alt text for thousands of banner images, improving SEO and accessibility while freeing teams to focus on creativity.

E‑Commerce

Retailers use simld to tag product images with brand, texture, and usage details—streamlining search, reducing returns, and boosting conversions.

Digital Asset Management

Organizations relying on DAM systems integrate simld to catalog and search vast archives effectively, discovering legacy media that would otherwise remain hidden.

Compliance & Rights Management

Legal teams rely on simld’s usage‑rights flags to prevent unauthorized use of copyrighted imagery, eliminating costly mistakes and liability.

Research & Publishing

Academics and journalists embed contextual metadata—such as location, date, and subject—ensuring clarity, provenance, and verifiability in published work.

Implementation Workflow: Simld in Action

-

Setup: Install simld SDK or connect via API.

-

Upload: Send images via batch upload or real‑time stream.

-

Analyze: Simld returns metadata JSON including tags, rights, and captions.

-

Review: Use optional dashboard for quality check.

-

Export: Push metadata to CMS, DAM, or file headers.

-

Iterate: Review reports. Re‑train the model as needed for niche content types.

This clear workflow demystifies the integration process. With simld, organizations minimize disruption and maximize results.

Addressing Objections: You Might Be Wondering

“Is simld expensive?” Not necessarily. Simld offers tiered pricing—from a free trial tier to enterprise plans—ensuring you pay only for what you need. ROI often comes within weeks via time saved and reduced legal exposure.

“What about privacy?” Simld processes data over encrypted channels, with optional on‑prem deployments for teams handling sensitive content.

“Can simld handle volume?” Absolutely. Simld scales horizontally across servers and cloud environments, supporting millions of images per day without bottlenecks.

Actionable Tips: Getting the Most from Simld

-

Enable custom taxonomy training for your industry to enhance metadata relevance.

-

Use batch mode overnight for archival collections to jump‑start your library.

-

Monitor simld’s confidence scores to flag images needing manual review.

-

Integrate with workflow automation tools, like Zapier or Integromat, to trigger actions after metadata generation.

-

Leverage simld’s reporting module to uncover content gaps and compliance metrics.

Future Roadmap: Growing with Simld

Simld plans to expand with features like video metadata extraction, deeper brand‑safety filters, sentiment analysis for image content, and multilingual captioning. These ensure that simld remains future‑proof in an increasingly complex media landscape.

Conclusion

In conclusion, simld empowers organizations and individuals with smart, accurate, and scalable image metadata solutions. By addressing compliance, efficiency, and contextual clarity, simld eliminates common pain points and builds confidence. Whether you’re tasking it with tagging e‑commerce photos, enriching digital archives, or safeguarding content usage, simld raises the bar on reliability and intelligence in visual media management.

FAQs

What is simld?

Simld is a smart image metadata lookup and detection framework that automates the extraction, interpretation, and embedding of metadata like tags, captions, usage rights, and location from visual content.

How does simld improve efficiency?

By automating image analysis and metadata creation, simld saves hours compared to manual tagging. It accelerates workflows, minimizes errors, and scales effortlessly to meet growing demands.

Is simld suitable for small businesses?

Yes. Simld offers tiered pricing—including free and starter plans—tailored to small businesses, enabling access to smart metadata tools without large upfront costs.

Can simld be customized for specific industries?

Absolutely. Simld supports custom taxonomy training, allowing precise adaptation to industries like healthcare, retail, publishing, or legal, enhancing the relevance and accuracy of metadata.

How secure is simld?

Simld uses industry‑standard encryption both at rest and in transit. It supports on‑prem deployments for sensitive content and logs audit trails for full transparency and compliance.

What integrations does simld support?

Simld integrates with REST APIs, popular CMS and DAM platforms, workflow automation tools, and custom applications, making it easy to adopt in varied environments.

EDUCATION

N-Gon Definition: What It Is and Why It Matters in Math and 3D Design

Understanding what an n-gon is can make a big difference—whether you’re solving geometry problems or refining a 3D model. In this guide, we break down the n-gon definition, its mathematical significance, and its role in fields like computer graphics and architectural modeling.

Let’s dive in.

What Is an N-Gon?

An n-gon is a geometric shape—specifically, a polygon—with n number of sides. The “n” is a variable that stands for any integer greater than or equal to 3.

- A triangle is a 3-gon.

- A square is a 4-gon.

- A pentagon is a 5-gon.

- …and so on.

So, an n-gon is simply a general term for any polygon with “n” sides.

In mathematics, the term helps describe polygons in a scalable way—without naming each shape individually.

Key Characteristics of an N-Gon

Whether regular (all sides and angles equal) or irregular (uneven sides/angles), all n-gons share some basic properties.

Properties of an N-Gon

- Number of sides: Exactly n sides.

- Number of angles: n internal angles.

- Sum of interior angles: (n−2)×180∘(n – 2) \times 180^\circ

- Can be regular or irregular: Based on side and angle uniformity.

- Convex vs. concave: Determined by internal angle measures.

Mathematical Use of N-Gons

In pure mathematics and geometry education, n-gons serve as tools to teach:

- Angle calculation

- Symmetry principles

- Polygon classification

They’re also foundational in proofs and theorems, such as tessellations and tiling problems.

N-Gons in 3D Modeling and Game Development

In 3D modeling software like Blender, Maya, or 3ds Max, the term “n-gon” has a different context. It refers to any polygon with more than four sides—used in modeling complex surfaces.

Why N-Gons Matter in 3D Graphics

- Easier modeling: Useful during the sculpting phase.

- Potential rendering issues: N-gons may deform poorly when animated.

- Topology concerns: Many engines prefer tris (3-gons) or quads (4-gons) for cleaner results.

Game engines like Unity or Unreal often require meshes to be converted to tris for real-time rendering.

Real-World Applications of N-Gons

Architecture and CAD

Designers use n-gons in structural diagrams and floor plans to represent irregular walls and surfaces.

Data Visualization

N-gons are used in radial charts or custom graph plotting in advanced data interfaces.

Education and Research

Geometry classes often use n-gons to teach concepts of measurement, symmetry, and polygon classification.

Pros and Cons of Using N-Gons

| Pros | Cons |

|---|---|

| Flexible in modeling complex shapes | Can create issues in animation |

| Reduce mesh density for organic forms | Not ideal for real-time rendering |

| Used in mathematical generalization | Harder to control in topology cleanup |

How to Work with N-Gons in Modeling

If you’re a 3D artist, here’s how to handle n-gons safely:

- Use during modeling, but convert to quads/tris before export.

- Clean up topology to avoid artifacts.

- Test animation deformations in rigged models.

Expert Opinions on N-Gons

Dr. Hannah Fry, mathematician and author, says:

“N-gons represent a beautiful simplicity in geometry—providing a formulaic way to understand complexity.”

Jonathan Williamson, Blender Foundation instructor:

“N-gons are great during early modeling stages, but clean quad-based topology is critical for professional-grade output.”

Dr. Michael Bailey, UC Davis Computer Graphics Professor:

“In real-time graphics, n-gons pose risks. Clean meshes with tris or quads are much more GPU-friendly.”

Common Mistakes to Avoid

- Relying on n-gons in game assets

- Ignoring non-planar faces in modeling

- Forgetting to triangulate meshes before export

Final Thoughts

The n-gon might sound like a complex term, but it’s simply a flexible way of referring to any polygon with “n” sides. Whether you’re a math student, digital artist, or engineer, understanding n-gons can streamline your work and reduce errors.

Master the n-gon, and you master a foundation of geometry and modeling.

FAQ’s

What is the difference between a polygon and an n-gon?

A polygon is the general term; an n-gon is a more technical way of saying “a polygon with n sides.”

Are n-gons bad in 3D modeling?

Not inherently, but they can cause problems in animation or real-time rendering if not triangulated properly.

How do you find the sum of interior angles of an n-gon?

Use the formula: (n−2)×180∘(n – 2) \times 180^\circ

Can an n-gon be regular?

Yes, if all its sides and angles are equal, it’s called a regular n-gon.

What’s the smallest possible n-gon?

The triangle (3-gon) is the smallest polygon that forms a closed shape.

EDUCATION

Anna’s Archive: The People’s Open Library in a Digital Age

Anna’s Archive is a free, open-source shadow library that aggregates and mirrors books, academic papers, and digital content from multiple sources—especially those that are often locked behind paywalls. Emerging from the ethos of information freedom and preservation, it became particularly prominent after the legal takedown of Z-Library in late 2022.

It’s not just a pirate website—it’s an ambitious archiving project that aims to preserve humanity’s knowledge for future generations. For students, researchers, and digital seekers frustrated by inaccessible paywalled journals or expensive textbooks, Anna’s Archive serves as a gateway to content that might otherwise be lost or hidden.

Who Uses Anna’s Archive and Why?

Target users of Anna’s Archive include:

- Students and researchers in developing nations or underfunded institutions

- Independent scholars without institutional access to major databases

- Digital librarians and archivists looking to preserve cultural or scientific heritage

- Tech-savvy individuals who value online anonymity and open access

Whether you’re finishing your dissertation or chasing an obscure research topic, Anna’s Archive offers a treasure trove of scholarly, historical, and technical resources.

Key Features of Anna’s Archive

Comprehensive Content Indexing

Anna’s Archive aggregates and mirrors from:

- LibGen (Library Genesis)

- Sci-Hub (for academic journals)

- Z-Library (mirrored collections)

- Internet Archive (metadata and mirror support)

With over 25 million books and growing, it has become one of the most extensive open databases in the world.

Powerful Search Capabilities

Users can:

- Search by title, author, ISBN, or topic

- Access multiple mirror links

- View metadata (formats, file size, tags)

- Choose from PDF, ePub, MOBI, and other formats

Privacy-Centric Design

Anna’s Archive is designed to protect user identity, offering:

- No login requirement

- HTTPS encryption

- .onion access via Tor for anonymous browsing

- An actively updated mirror list in case domains are blocked

“Anonymity is a feature, not a flaw. Information wants to be free, and people deserve access to knowledge regardless of borders or bureaucracy.”

— Anna’s Archive Manifesto

Legal and Ethical Considerations

Anna’s Archive exists in a legal gray zone. While the project claims to preserve and democratize information, many publishers argue it facilitates copyright infringement.

According to Dr. Alexandra Elbakyan, founder of Sci-Hub:

“If knowledge is a human right, then the tools to access that knowledge must be accessible too.”

— Interview with Wired Magazine, 2023

Important: Users must understand the legal implications in their region. Some countries treat access to shadow libraries as illegal, while others are more lenient. Use tools like VPNs and Tor Browser cautiously and ethically.

How to Safely Use Anna’s Archive

If you decide to explore Anna’s Archive, here are some safety tips:

- Always use HTTPS or visit via Tor (.onion) address

- Don’t share personal info on any shadow library platforms

- Use VPNs to obscure your IP

- Avoid downloading executable files or anything suspicious

Anna’s Archive itself doesn’t host malware, but third-party mirrors might.

Why Anna’s Archive Matters in 2025

With rising digital censorship and academic gatekeeping, platforms like Anna’s Archive represent a counterculture movement for open access. They’re not just tools—they’re statements.

“We are in an age where digital preservation is activism. Anna’s Archive is our modern-day Library of Alexandria.”

— Dr. Carla Reyes, Digital Archivist at MIT

Alternatives and Complementary Resources

If you’re seeking legal or open-access platforms, consider:

- Internet Archive (https://archive.org) – Public domain books, historical media

- Directory of Open Access Journals (DOAJ) – Peer-reviewed academic articles

- Open Library (https://openlibrary.org) – Borrow eBooks with a free account

- Project Gutenberg – Free eBooks, mostly classics in public domain

Anna’s Archive is best viewed as a supplement, not a replacement, for legal sources.

Final Thoughts

Anna’s Archive is more than a database—it’s a digital lifeline for millions worldwide. As academia grows more expensive and online information becomes increasingly gated, platforms like Anna’s Archive provide a radical alternative rooted in equity and preservation.

If you’re a privacy-conscious researcher or student navigating limited access, Anna’s Archive might just be the hidden gem you didn’t know you needed.

FAQ’s:

Is Anna’s Archive legal?

It depends on your country. While Anna’s Archive itself does not host content directly, it indexes and mirrors databases that are controversial and often banned.

Is it safe to use?

If accessed via HTTPS or Tor and used responsibly (no personal data, no executable files), it’s relatively safe. A good VPN is also recommended.

What types of content can I find?

- Textbooks

- Academic research

- Fiction and non-fiction

- Technical manuals

- Historical and cultural texts

Can I contribute to the archive?

Yes, through metadata corrections or hosting mirrors. Developers can also contribute to the open-source project via GitHub.

Is it available in multiple languages?

The site supports international searches, though most metadata and titles are in English.

EDUCATION

Understanding n-gon Geometry: A Beginner-Friendly Guide Understanding n-gon Geometry: A Beginner-Friendly Guide

Geometry plays a crucial role in mathematics and real-world problem-solving. One concept that often puzzles students is the idea of the n-gon. Whether you’re preparing for a school exam, building a math project, or just curious about polygons, this guide breaks it down simply and clearly.

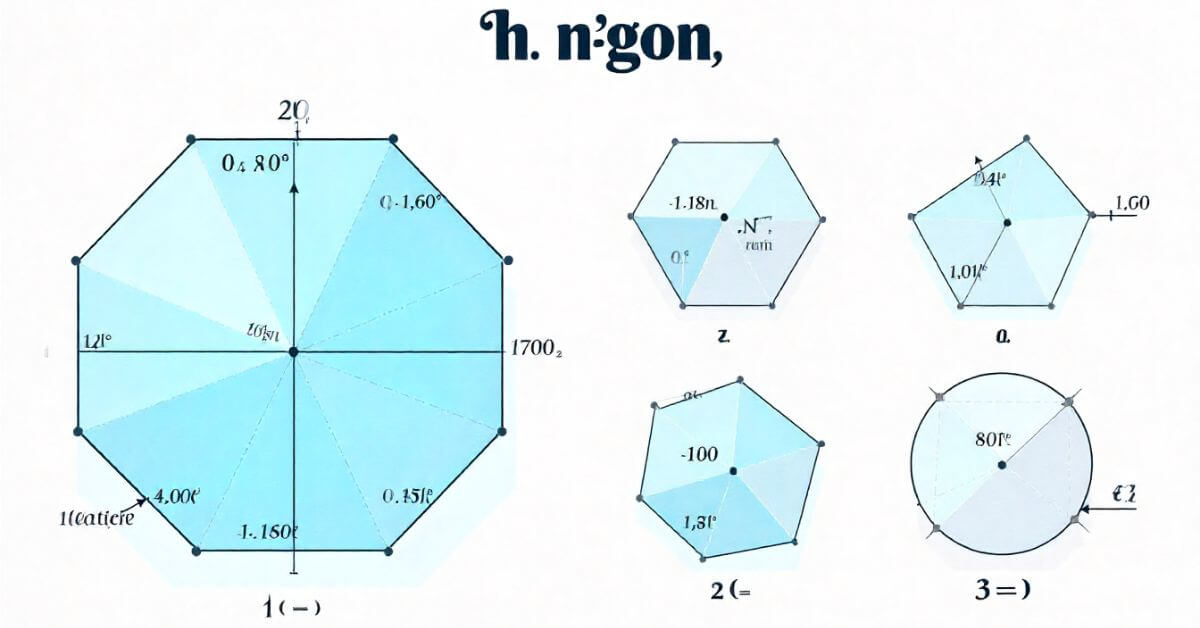

What Is an n-gon in Geometry?

An n-gon is a polygon with “n” sides, where “n” is any integer greater than or equal to 3. That means if a shape has 3 sides, it’s a 3-gon (triangle); if it has 8 sides, it’s an 8-gon (octagon), and so on.

Key Characteristics of an n-gon:

- It is a closed shape formed by straight line segments.

- The sides meet at vertices (corners).

- Each interior angle connects two sides.

- “n” can be any whole number ≥ 3.

Examples of Common n-gons:

| n | Name of Polygon | Shape Example |

|---|---|---|

| 3 | Triangle | ▲ |

| 4 | Quadrilateral | ■ |

| 5 | Pentagon | ⬟ |

| 6 | Hexagon | ⬢ |

| 8 | Octagon | ⬣ |

| 10 | Decagon | ⬡ |

How to Classify n-gons

n-gons can be classified based on side length, angle size, and symmetry.

Regular vs. Irregular n-gons

- Regular n-gon: All sides and angles are equal.

- Irregular n-gon: Sides and/or angles are not equal.

Convex vs. Concave n-gons

- Convex n-gon: All interior angles are less than 180°.

- Concave n-gon: At least one interior angle is greater than 180°.

Why Understanding n-gons Matters

Knowing how to identify and work with n-gons is foundational in:

- Geometry problems involving angles, perimeter, and area.

- Computer graphics and modeling (used in game design and animation).

- Architecture and engineering, where precise shapes are essential.

How to Calculate Interior Angles of an n-gon

One of the most useful properties of an n-gon is its interior angles.

Formula:

Sum of interior angles = (n – 2) × 180°

For a regular n-gon:

Each angle = [(n – 2) × 180°] / n

Example:

For a regular pentagon (n = 5):

- Sum = (5 – 2) × 180 = 540°

- Each interior angle = 540 / 5 = 108°

Real-World Applications of n-gons

Learning about n-gons isn’t just for math class. These shapes appear in:

- Architecture: Dome patterns and tile layouts

- Science: Molecular structures and atomic models

- Technology: Computer-aided design (CAD), 3D modeling, and game design

- Art: Mandalas, tessellations, and geometric painting styles

Expert Insights and References

“Polygons, especially regular n-gons, form the building blocks of geometric understanding. Their properties are widely used in both academic and applied settings.”

— Dr. Nancy L. DeVault, Professor of Mathematics, Mathematical Association of America (MAA)

“In computer graphics, regular n-gons are key in mesh generation and surface modeling.”

— Prof. David Mount, Computer Science Department, University of Maryland, CMSC 420 Geometry Lecture Series

“Understanding the sum of interior angles is foundational for students, and it builds essential logical reasoning skills.”

— Khan Academy Geometry Curriculum, Khan Academy

Final Thoughts

The concept of an n-gon might seem simple, but it holds tremendous importance in both math theory and real-life applications. Whether you’re solving geometry problems or designing complex patterns, mastering n-gons gives you a strong foundation in spatial reasoning and logical thinking.

Keep practicing. The more shapes you explore, the more patterns you’ll recognize!

EXPLORE MORE

FAQ,s

What is the minimum value of “n” for an n-gon?

Answer: The smallest polygon has 3 sides, so n = 3 (a triangle).

Can an n-gon have curved sides?

Answer: No, by definition, polygons (and therefore n-gons) must have straight sides.

Is a circle an n-gon?

Answer: A circle is not an n-gon because it has no straight sides or vertices. However, a polygon with a very large “n” (e.g., 1000-gon) can approximate a circle visually.

How do I construct a regular n-gon?

Answer: Use a protractor and compass for precise angle division. In software like GeoGebra or CAD tools, you can generate them with just a few clicks.

What is the use of learning about n-gons?

Answer: Besides exams and tests, understanding n-gons helps with problem-solving in design, engineering, programming, and more.

-

TECH5 months ago

TECH5 months agoOnionPlay Safe to Use in 2025? | Safer Alternatives, Privacy Tips & VPN Picks

-

TECH5 months ago

TECH5 months agoDooflix App for PC: Best Ways to Use It on Windows 10/11

-

TECH5 months ago

TECH5 months agoIs Scrolller Safe? A 2025 Guide to NSFW Browsing with Confidence

-

BLOG6 months ago

BLOG6 months agoMedihoney: The Natural Healing Power Revolutionizing Wound Care

-

TECH5 months ago

TECH5 months agoIs F95 Safe? A Complete 2025 Guide for Privacy-Conscious NSFW Gamers

-

BUSINESS6 months ago

BUSINESS6 months agoBloomberg Billionaires Index: Unveiling the Wealthiest Lives

-

BUSINESS6 months ago

BUSINESS6 months agoHuns Yellow Pages: The Ultimate Business Directory for Local Searches

-

EDUCATION5 months ago

EDUCATION5 months agoAnna’s Archive: The People’s Open Library in a Digital Age